Nigeria’s pension assets have surged past ₦25 trillion, marking a historic milestone in the country’s economic landscape, according to the Director-General of the National Pension Commission (PenCom), Ms. Omolola Oloworaran.

While speaking at a Sensitization Workshop on the Contributory Pension Scheme (CPS) for pensioners across the North-West geopolitical zone in Kano State, Oloworaran said the growth demonstrates how pension funds are fueling national development through strategic and transparent investments.

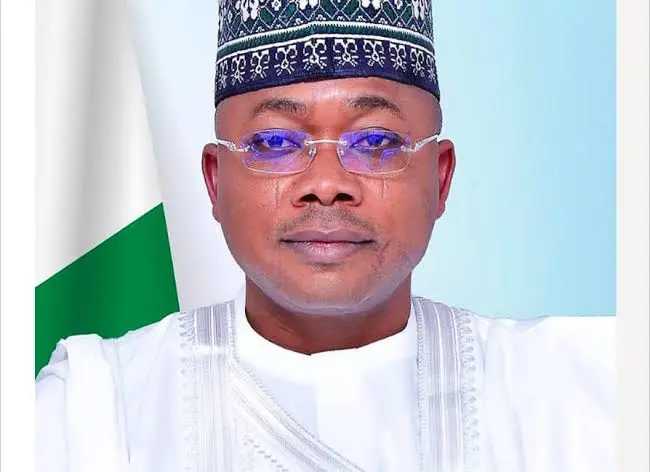

Oloworaran who was represented by Hafiz Kawu Ibrahim, PenCom’s Commissioner for Technical Services, described the CPS, introduced two decades ago as a “game-changer” that has rewritten Nigeria’s pension story, moving the nation from “an era of unpaid entitlements to a transparent, sustainable system.”

“Today, more than 10 million Nigerians from both public and private sectors, including artisans and the self-employed under the Personal Pension Plan, are covered by the scheme,” she said.

According to PenCom DG, over 552,000 retirees currently receive monthly pensions, while 291,735 others have collected their lump-sum benefits, bringing the total number of beneficiaries to over 844,000 retirees nationwide.

She also unveiled a raft of reforms under “Pension Revolution 2.0,” including:

Enhancement of pensions for 241,000 retirees, representing 80% of those under the programmed withdrawal system, raising monthly payments from ₦12.15 billion to ₦14.83 billion effective June 2025, Zero waiting time for new pension payments, Reintroduction of gratuity for civil servants, FGN bond issuance to settle pension liabilities and Introduction of five new regulatory instruments, including whistleblowing guidelines, revised investment regulations, and frameworks for accredited pension agents.

In a major social welfare boost, Oloworaran announced that PenCom will soon introduce Free Health Insurance for Retirees, beginning with those in lower-income brackets, to “ensure dignity and security beyond financial pensions.”

Lauding the success of the CPS, the DG acknowledged lingering challenges, especially slow adoption by some states and private employers yet to fully implement the scheme.

“Reform is a continuous journey,” she noted. “Our ultimate goal is to protect every contributor and guarantee dignity in retirement for all Nigerians.”

The Kano workshop, jointly organized by PenCom and the National Salaries, Incomes and Wages Commission (NSIWC), was attended by representatives of the Federal Ministry of Finance, Budget Office, Office of the Accountant-General of the Federation, National Orientation Agency (NOA), and various pension unions.